venmo tax reporting limit

The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such. And if you get paid through digital apps like PayPal Cash App Zelle or Venmo theres a new tax reporting law that could impact your tax return.

New Reporting Requirements For 1099 K

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to.

. This new regulation a. Previously limits surrounding reporting of income received through payment cards and third-party. In this photo illustration a.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report. The American Rescue Plan Act lowered the threshold for reporting P2P network transactions. If you have not yet completed identity verification you will have.

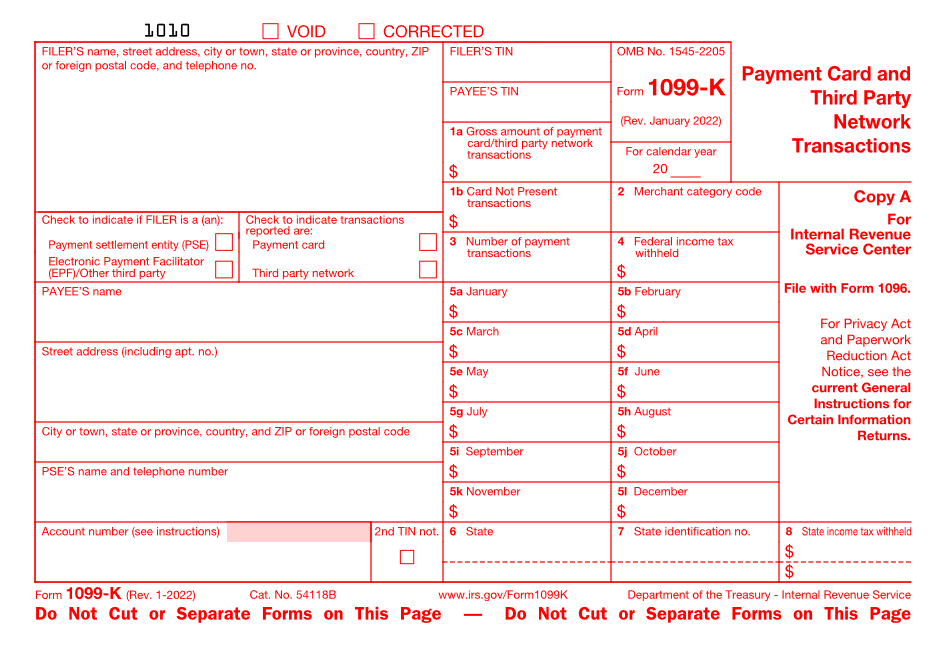

For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year. TPSOs like PayPal and Venmo.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. For the 2021 tax year Venmo will. Venmo CashApp and other third-party.

A business transaction is. What Your Business Needs To Know. Rather small business owners independent.

Jan 25 2022 157 PM. But Venmo tax reporting laws have changed and this change applies to all other P2P apps too. By Tim Fitzsimons.

How these new tax reporting changes may impact you when paying or accepting payments with PayPal and Venmo for goods and services. Read on for more information about these limits. January 19 2022 204 PM 2 min read.

This new rule wont affect 2021 federal tax returns but now. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. Venmo has some limits on how much you can send in a given week.

Its important to make sure that your tax information on Venmo matches IRS records so were here to help if you need to change the info on your tax forms. Starting the 2022 tax. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more.

PayPal Zelle Venmo Taxes. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes.

If you use PayPal Venmo or other P2P platforms. For most states the threshold. If the funds being transferred are for goods or a service the new law simply requires businesses to report those funds exceeding 600 rather than the old 20000 limit.

Terminate this user agreement limit your Venmo andor PayPal account andor close or suspend your Venmo andor PayPal account. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year.

Network Payment Reporting Threshold Of 600 Goes Into Effect Frazier Deeter Llc

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Tax Code Change Affects Mobile Payment App The Hawk Newspaper

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

/venmo-side-hustle-2000-bd5c09154d2e465abe5e500b5c8f991a.jpg)

How Venmo And Paypal Affect Your Taxes

New Venmo Tax Law Are You Filing Correctly Behindthechair Com

Businesses Accepting Venmo And Other Digital Payments Need To Be Aware Of New Tax Reporting Requirements Anders Cpa

Paypal Taxes 2022 How Big Are The Transactions This App And Venmo Report To The Irs Marca

/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

How Safe Is Venmo And What Are Its Fees

How Using Paypal And Venmo Affects Your Taxes As A Freelancer

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

/cloudfront-us-east-1.images.arcpublishing.com/gray/VGFJPQ3KWRCWLN2NCMVB57LQ5U.jpg)