closed end loan trigger terms

Open-End Loan Disclosures for Skip a Payment. Amount or percentage of any down payment Number of payments or the period of repayment Payment amounts The finance charge Use of any of these terms requires clear and conspicuous disclosure of the following additional information.

1 The amount or percentage of any downpayment.

. There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products. 2 The number of payments or period of repayment. Mortgage Loans - TILARESPA Integrated Disclosures TRID If the loan is 1 closed end 2 Reg Z applies consumer purpose and 3 the security is ANY dirt land then TRID applies.

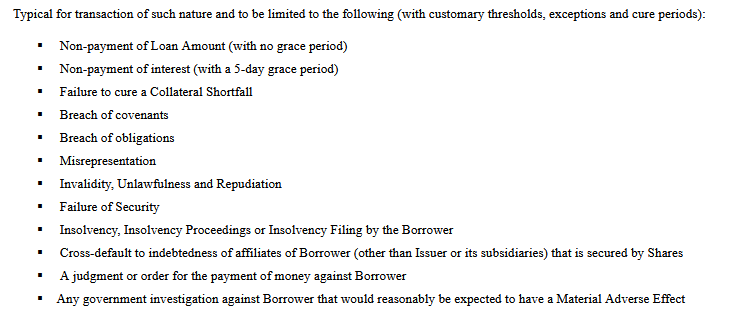

The minimum amounts must be determined by assuming that the interest rate in effect throughout the loan term is the minimum. The regulation was also revised to reflect the 1995 Truth in Lending amendments that dealt primarily with tolerances for. Of this section that trigger the imposition of the rate increase.

The trigger terms for closed-end loans are. 22619a1 and 22619a2 10. Stating No downpayment does not trigger additional disclosures.

TRID rules apply to MOST consumer credit transactions secured by real property. Iii The amount of any payment. If the annual percentage rate may be.

The skip payment features that would be. I The amount or percentage of any downpayment. Section 102635 prohibits specific acts and practices in connection with closed-end higher-priced mortgage loans as defined in 102635a.

Triggering terms are words or phrases that must be accompanied by a disclosure when theyre used in advertising. Disclosure Requirements for Skip-a-Payment Programs. Up to 48 months to pay 90 percent financing As low as 50 a.

These provisions apply even if the triggering term is not stated explicitly but may be readily determined from the advertisement. The annual percentage rateusing that term spelled out in full. Iv The amount of any finance charge.

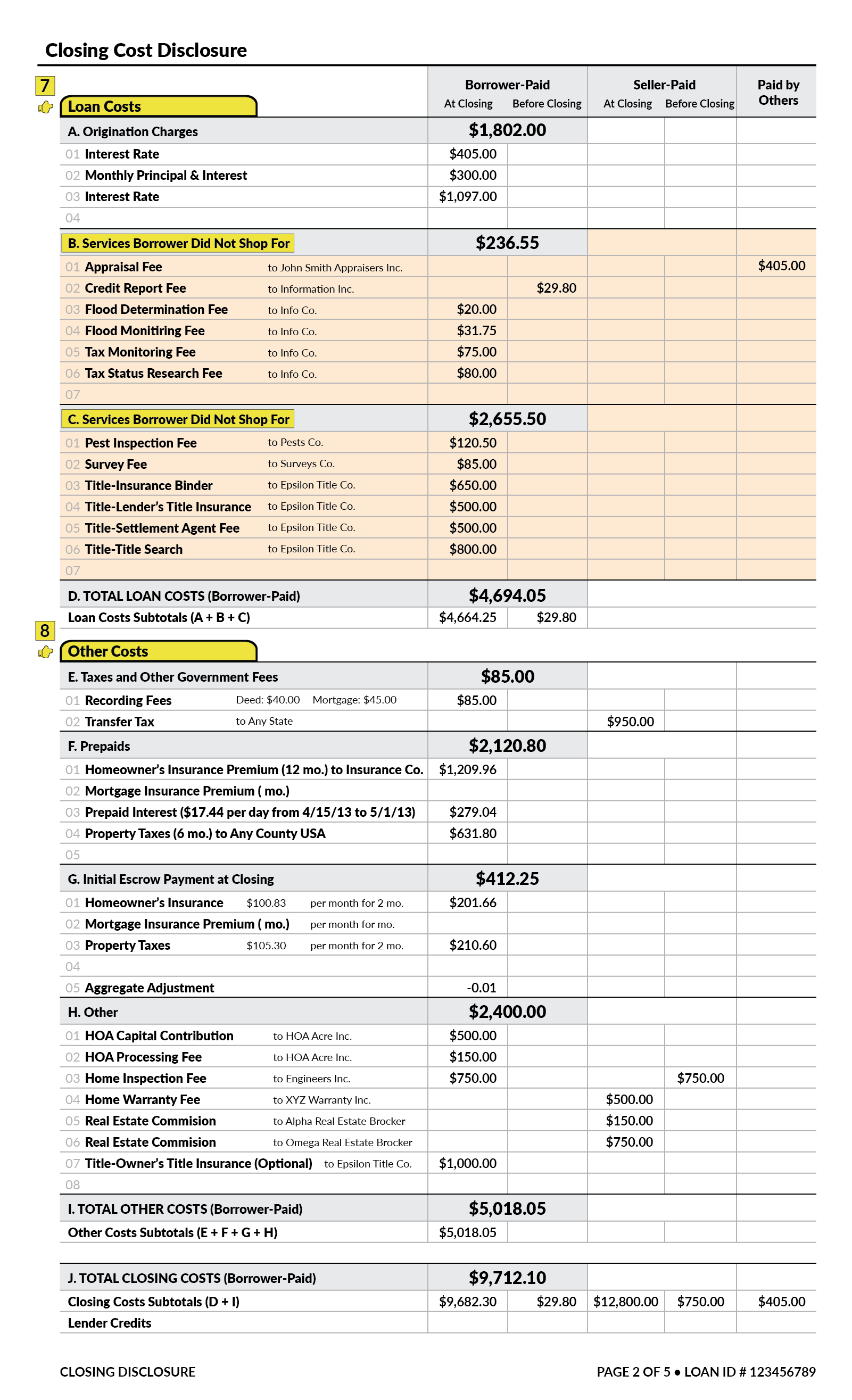

Question - Our advertising division is creating a brochure to market our various closed-end mortgage products. Closed-End Auto Loan Ads. If any of the above trigger terms are present.

Membership or Participation Fees. Must be determined by assuming the maximum principal amount permitted under the terms of the legal obligation at the end of the loan term period. Closed-end consumer credit transactions secured by real property or a.

Loans because the terms and rates were seldom presented in the same format. If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement. If the features of the skip payment program are disclosed in the account-opening disclosure the credit union does not have to provide a change-in-terms notice.

However the APR is a triggering term for open-end credit. For instance a few terms for closed end credit that trigger the need for additional disclosure are. Converting open-end to closed-end credit.

Credit sales only ii The number of payments or period of repayment. Trigger terms when advertising a closed-end loan include. A membership fee is not a triggering term nor need it be disclosed under 102616b1iii if it is required for participation in the plan whether or not an open-end credit feature is.

Triggering terms for closed-end loans. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the abbreviation APR. Higher-cost closed-end mortgage loans and included new disclosure requirements for reverse mortgage transactions.

Triggered Terms 102616 b. The rule does NOT apply to Home Equity Line of Credit transactions. Missing additional disclosures on auto loans 1 Triggering terms.

Except for home equity plans subject to 102640 in which the agreement provides for a. Change-in-terms and increased penalty rate summary for open-end. 3 The amount of any payment.

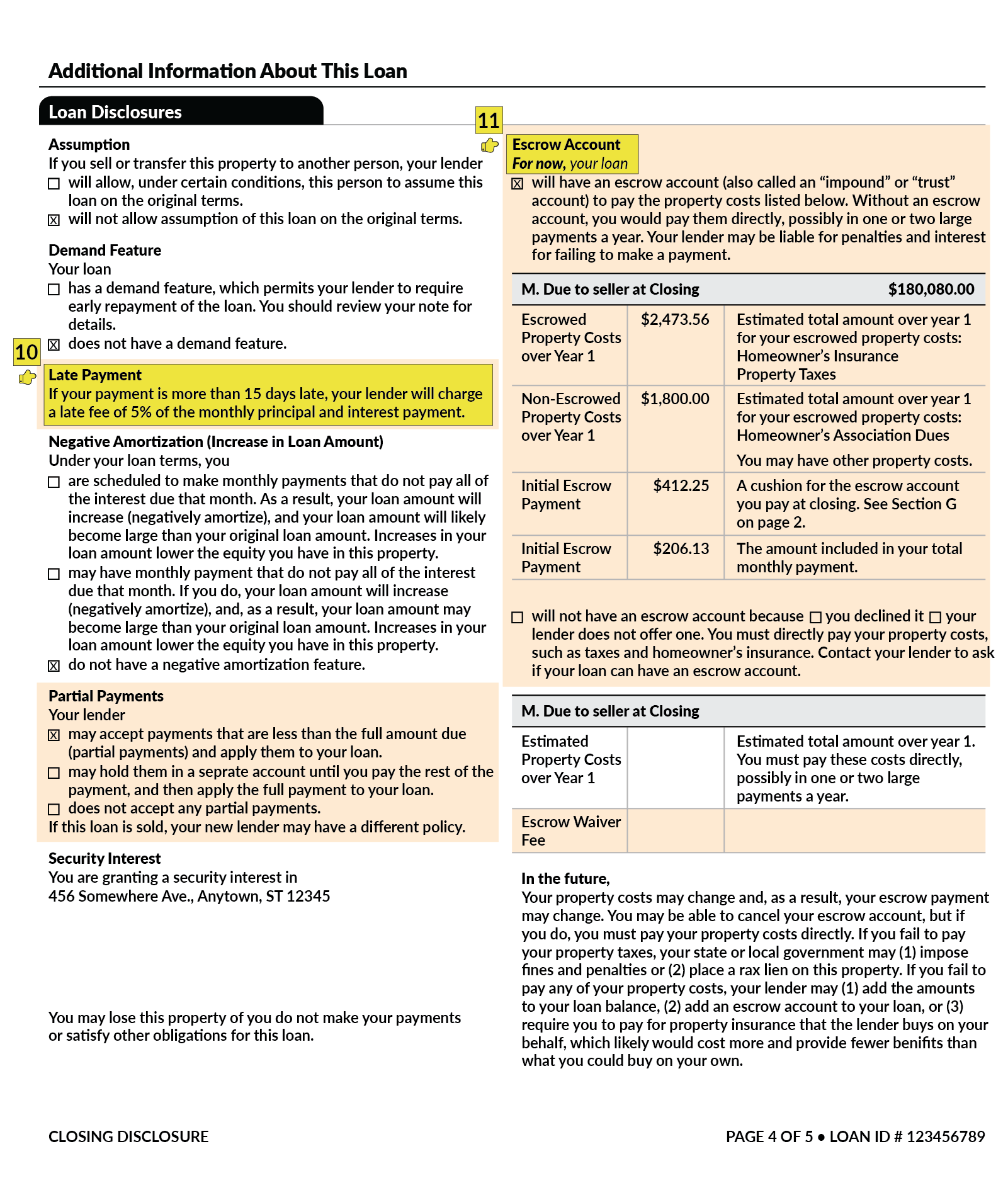

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written application and at least seven 7 business days before consummation. Under 102624 d 1 whenever certain triggering terms appear in credit advertisements the additional credit terms enumerated in 102624 d 2 must also appear. The APR is not a trigger if its a closed-end loan.

What Kinds Of Loans Do TRID Disclosures Cover. Trigger Terms Under Regulation Z. Refer to Section 22624 for closed-end advertising requirements and Section 22616 for open-end advertising.

These include mortgages refinancing construction-only loans closed-end home-equity loans and loans secured by vacant land or by 25 or more acres. For example when advertising closed-end credit products such as mortgages or. The brochure indicates for one product that 100 financing is available and states for another that Loans are typically from three to five years.

4 The amount of any finance charge. These disclosures are mandated by the TILA which is designed to protect consumers from inaccurate and unfair credit billing and credit card practices. If the plan provides for a variable rate that fact must be disclosed.

Unfortunately noif during the loan term a HELOC is converted from open-end credit to closed-end credit that would trigger closed-end credit requirements including the TRID disclosures as set out here. Are these trigger terms under Regulation Z. The terms of repayment.

For closed end dwelling-secured loans subject to. The number of payments or period of repayment such as 48-month payment term or 30-year mortgage this is often the most overlooked triggering term The amount of any payment 550 per month The amount of any finance charge 500 origination fee 2 points. Section 102616b applies even if the triggering term is not stated explicitly but may be readily determined from the advertisement.

The amount or percentage of the down payment.

Federal Register Regulation Z Truth In Lending

/loan_86800398-5c477b1146e0fb0001db7364.jpg)

Signature Loan A Popular Type Of Unsecured Loan

What Is A Closing Disclosure Lendingtree

What Your Mortage Company Needs To Know About Hoepa

Federal Register Regulation Z Truth In Lending

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

What Is A Closing Disclosure Lendingtree

Here Are 150 Personal Finance Terms You Should Know

Performance Measurement Inrev Guidelines

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

Tesla Stock As Collateral To Buy Twitter Avoid Buying The Dip Nasdaq Tsla Seeking Alpha

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Forward Flow Arrangements A Viable Alternative To Warehouse Financing Structures As A Means Of Funding Mortgage Loan Origination Insights Dla Piper Global Law Firm

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)

:max_bytes(150000):strip_icc()/401_k_istock479882934-5bfc328f46e0fb0051bf266e.jpg)